Is Sales Tax Charged On A Service . Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. Currently, many states exclude service providers from sales and use. Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. Under that scenario, if your business sells. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Sales tax increasingly applies to pure service businesses. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1.

from www.chegg.com

In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Sales tax increasingly applies to pure service businesses. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. Currently, many states exclude service providers from sales and use. Under that scenario, if your business sells. Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction.

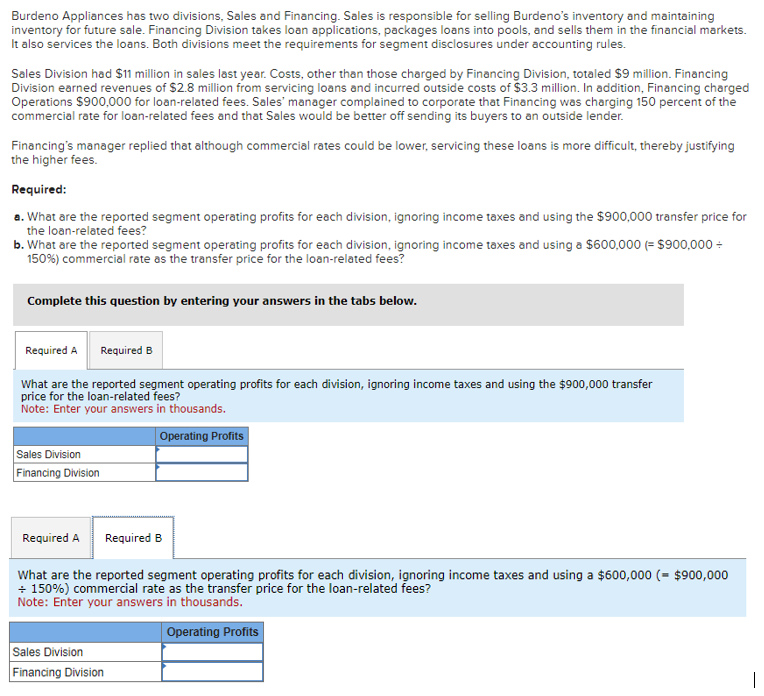

Solved Burdeno Appliances has two divisions, Sales and

Is Sales Tax Charged On A Service Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. Under that scenario, if your business sells. Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. Sales tax increasingly applies to pure service businesses. Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Currently, many states exclude service providers from sales and use. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax).

From www.teachoo.com

Ex 7.2, 2 The price of a TV is Rs 13,000. The sales tax charged on Is Sales Tax Charged On A Service Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt. Is Sales Tax Charged On A Service.

From taxwalls.blogspot.com

Do You Have To Charge Sales Tax Tax Walls Is Sales Tax Charged On A Service The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Currently, many states exclude service providers from sales and use. Sales tax is im posed on sales where. Is Sales Tax Charged On A Service.

From www.lao.ca.gov

Understanding California’s Sales Tax Is Sales Tax Charged On A Service In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Currently, many states exclude service providers from sales and use. Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. Gst is charged on all sales of goods and services made. Is Sales Tax Charged On A Service.

From www.educba.com

Sales Tax Types and Objectives of Sales Tax with Examples Is Sales Tax Charged On A Service Under that scenario, if your business sells. Sales tax increasingly applies to pure service businesses. Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Gst is charged on. Is Sales Tax Charged On A Service.

From mirrorcommercial12.gitlab.io

Wonderful Rcm Invoice Format Under Gst In Excel Sales Forecast Sheet Is Sales Tax Charged On A Service Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services.. Is Sales Tax Charged On A Service.

From quadrantbiz.co

Introduction to Sales and Service Tax (SST) Quadrant Biz Solutions Is Sales Tax Charged On A Service Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. Sales tax increasingly applies to pure service businesses. The challenge for businesses is determining which services are taxable in. Is Sales Tax Charged On A Service.

From www.business2community.com

Amazon Sales Tax Everything You Need to Know Is Sales Tax Charged On A Service Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. Currently, many states exclude service providers from sales and use. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. The challenge for businesses is determining which services are taxable in. Is Sales Tax Charged On A Service.

From webhelp.karmak.com

Service Sales Tax Charged (ARM40485) Is Sales Tax Charged On A Service Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. Sales tax increasingly applies to pure service businesses. The challenge for businesses is determining which services are taxable in. Is Sales Tax Charged On A Service.

From www.jagoinvestor.com

Service Charge, Service Tax and VAT on Restaurant/Hotel Bills Is Sales Tax Charged On A Service Under that scenario, if your business sells. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. In singapore, the sale and lease of residential properties, financial services, investment. Is Sales Tax Charged On A Service.

From learn.financestrategists.com

Accounting for Sales Tax Definition, Explanation & Examples Is Sales Tax Charged On A Service Currently, many states exclude service providers from sales and use. Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. The challenge for businesses is determining which services are taxable in. Is Sales Tax Charged On A Service.

From www.quaderno.io

The Ultimate Guide to EU VAT for Digital Taxes Is Sales Tax Charged On A Service In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Under that scenario, if your business sells. Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. Sales tax is im posed on sales where the transfer of title or possession. Is Sales Tax Charged On A Service.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Is Sales Tax Charged On A Service The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Sales tax increasingly applies to pure service businesses. Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. In singapore, the sale and lease of residential. Is Sales Tax Charged On A Service.

From www.youtube.com

HOW MUCH TO CHARGE FOR TAX SERVICES? YouTube Is Sales Tax Charged On A Service Sales tax increasingly applies to pure service businesses. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. Currently, many states exclude service providers from sales and use. Under. Is Sales Tax Charged On A Service.

From www.chegg.com

Solved Burdeno Appliances has two divisions, Sales and Is Sales Tax Charged On A Service In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Currently, many states exclude service providers from sales and use. Gst is charged on all sales of goods. Is Sales Tax Charged On A Service.

From www.compliancesigns.com

OSHA The Prices Of All Taxable Items Include Sales Tax Sign ONE33994 Is Sales Tax Charged On A Service In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Under that scenario, if your business sells. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Currently, many states exclude service providers from sales and use. Gst. Is Sales Tax Charged On A Service.

From www.teachoo.com

Difference between Tax Invoices and Bill of Supply Chapter 5 GST Inv Is Sales Tax Charged On A Service Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. Unfortunately, collecting sales tax isn’t quite as easy as taking on an extra charge to your goods or services. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from. Is Sales Tax Charged On A Service.

From www.teachoo.com

Example 8 Sales Tax and Value Added Tax Is Sales Tax Charged On A Service Currently, many states exclude service providers from sales and use. The challenge for businesses is determining which services are taxable in states where they have nexus (an obligation to collect sales tax). Sales tax increasingly applies to pure service businesses. Sales tax is im posed on sales where the transfer of title or possession occurs within the taxing jurisdiction. Gst. Is Sales Tax Charged On A Service.

From www.youtube.com

How to Charge Sales Tax on Avon Orders YouTube Is Sales Tax Charged On A Service Gst is charged on all sales of goods and services made in singapore, except for exported goods, international services and exempt supplies. In singapore, the sale and lease of residential properties, financial services, investment precious metals, and digital payment tokens (from 1. Sales tax increasingly applies to pure service businesses. Under that scenario, if your business sells. Unfortunately, collecting sales. Is Sales Tax Charged On A Service.